New Study Finds Cannabis Could Bring Big Bucks To Illinois If…

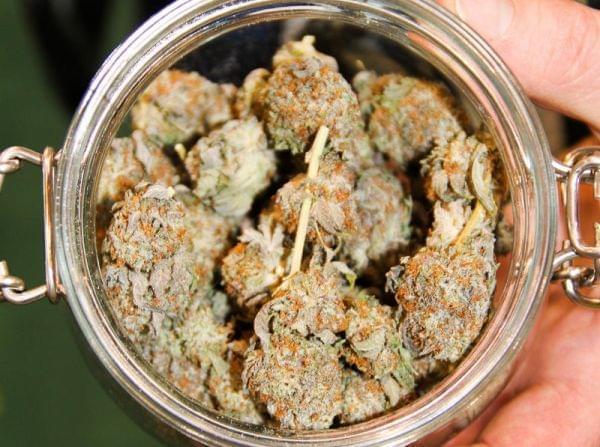

Flickr: Cannabis Culture / Attribution 2.0 Generic (CC By 2.0)

Illinois has been mulling over the idea of legalizing recreational cannabis for years. A state-sponsored study suggests that supporters' may have over-estimated the amount of tax revenue that could be gained by legalization.

Some proponents tout marijuana legalization as a social justice issue, others focus on the additional revenue it could bring in for the cash-strapped state.

How much would that be? Numbers have ranged from $350 million all the way up to $1 billion dollars annually. State Rep. Kelly Cassidy (D-Chicago) is spearheading the legislation and has said it's probably somewhere closer to $500 million. But a new study released on Friday shows that those initial estimates may be a bit too high.

Commissioned by state lawmakers, the study estimated tax revenues would range roughly from $445 to $675 million per year. However, there are some significant caveats. Those figures are based on a fully mature market, which means it will take some time to work up to that amount. The figures also assume consumers are using the drug "in stable numbers," purchasing it legally, and that no one is growing it at home.

Home grow has been a contentious aspect in legalized programs across the country, and is still being discussed as a possibility for Illinois. Law enforcement is against the idea, but advocates say allowing people to grow it at home could remove a financial barrier for people who need to use the drug medically.

Another factor is competition with neighboring states. Michigan legalized their program in November 2018 and have proposed a 6 percent sales tax and 10 percent excise tax — some of the lowest recreational cannabis taxes in the nation.

Cassidy's proposal has not been finalized, so Illinois’ potential tax structure remains an open question. However, the study assumes Illinois' recreational cannabis will be taxed at 26 percent, making Illinois cannabis much more expensive than Michigan marijuana.

The study states: "While traveling to Michigan for cannabis will not be convenient or even preferable for residents of Illinois, some will still use Michigan as a substitute, given its proximity to the state’s major population center, the number of Illinois residents with family or friends in Michigan, and the competition that would be created in neighboring states like Indiana."

Another finding says demand could reach as high as 550,000 pounds per year. The infrastructure the state has in place now — for its medical marijuana program — could supply only about half that. According the study, this capacity problem should be considered when implementing a legalized program so the state does not run out of product and can keep up with demand for those who need it medically.

State Sen. Heather Steans (D-Chicago), who is also sponsoring the legislation, said these findings do not change the timeline to legal sales in Illinois. “It’s a process because there’s a lot of people we’re getting input from,” she says. “Certainly we want to pass it by the end of May is the goal, so certainly well before that we’ll have to be filing a draft.”

Steans’ and Cassidy's proposal is not expected to be filed until March or April as they continue to work through how to tax the product, where the tax money will go, and other key details.

The demand study was completed by the Colorado-based consulting firm Freedman & Koski. According to their website, they ensure "successful implementation" of legalized recreational marijuana programs.