Mid-2017 State Income Tax Rate Hike Throws Off Taxpayers

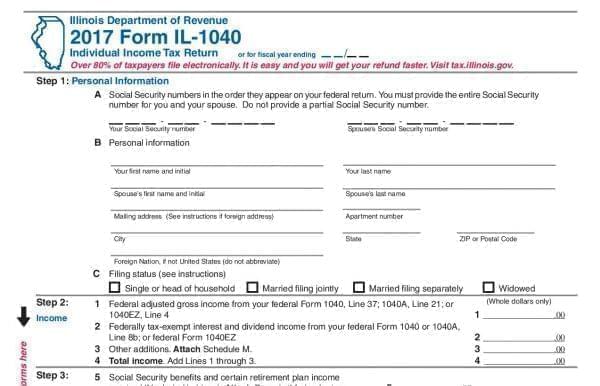

Illinois State Income Tax Form State Of Illinois

Tax season. We have it every year. You file your state income taxes. Sometimes you get a big refund. Yet, some people say they are surprised by how much money they owe this time around.

The deadline for filing income taxes comes two days later than usual this year, on Tuesday, April 17. But in Illinois, there’s another big difference--a mid-year change in the state income tax rate in 2017.

Bluestem Financial Advisors’ Jacob Kuebler says that change threw some Illinois taxpayers off.

“I think there was a lot of people that were taken off guard," said Kuebler. "And didn’t recognize or maybe weren’t even aware, that the Illinois legislature did in fact pass a new tax plan last year.”

How much more are people paying? He says the new state income tax rate for households is 4.95%—up from 3.75% that was the rate until July first. The blended rate--or the average of the two--is 4.35%.

He says some employers have to go extra hoops to figure out what to withhold from their employees’ paychecks.

“From what I’ve seen, some employers are going to outsource that," said Kuebler. "And they’re gonna use big companies that do payroll for employers nationwide.”

He says employers calculating payroll internally need new, updated tax tables to calculate the correct amount—which smaller companies may not have been aware of.

Kuebler was a guest this week on the public radio talk show, “The 21st."